India processed nearly 118 billion digital transactions in 2023, representing a 60% increase from the previous year. By 2024, that number had already grown to 172 billion, making the country the clear leader in digital payments worldwide.

More people are paying online, more businesses are scaling faster and trust in digital systems is becoming non-negotiable. With this scale comes a sharper focus on security and compliance. Companies now need more than just a fast checkout.

The best Indian payment gateway ensures that every transaction is secure, compliant and seamless, providing businesses with the foundation they need to build lasting customer confidence.

We highlight how the best Indian payment gateway ensures seamless compliance while delivering secure, flexible and efficient digital transactions.

Key compliance standards for Indian payment gateways

Compliance is the foundation of secure digital transactions. It protects customers, safeguards sensitive data and ensures that businesses operate within legal frameworks. Without these standards, even the most advanced payment solutions can leave users exposed to fraud or penalties. The best Indian payment gateway stands out because it seamlessly integrates these rules while still offering smooth user experiences.

1. PCI DSS certification

Payment gateways must comply with PCI DSS to protect cardholder data. This global standard prevents card fraud by enforcing strong encryption and secure handling of sensitive information.

2. RBI guidelines

The Reserve Bank of India issues directives around data storage, tokenisation and KYC norms. These rules ensure that payments remain secure and transparent.

3. Data localisation

RBI requires that all payment data generated in India be stored within the country. This ensures stronger accountability, easier regulatory oversight and added protection against cross-border risks, giving businesses and customers greater confidence in data security.

4. AML and CFT compliance

Payment gateways must comply with Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT) standards. These measures prevent the misuse of financial channels for illegal activity.

5. Secure multi-factor authentication

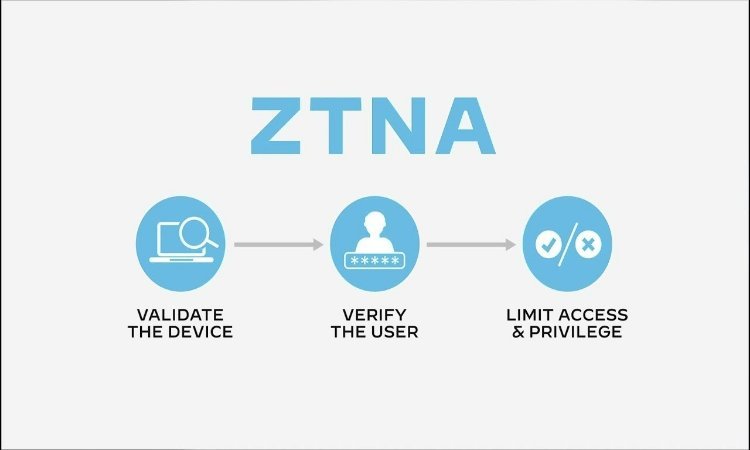

Regulatory frameworks require multi-factor authentication. The best payment gateways support these requirements while keeping the user journey swift and friction-free. This ensures stronger protection against unauthorised access without slowing down the checkout process.

Benefits for businesses using a compliant payment gateway

Compliance is not just about meeting regulations. It also brings clear advantages that support business growth and customer confidence. A secure and transparent payment process gives companies a strong foundation to expand without unnecessary risks. The best Indian payment gateway helps businesses meet these needs while keeping transactions seamless.

1. Reduced regulatory risk and penalties

A compliant gateway protects merchants from fines or legal action. It ensures that every transaction aligns with RBI rules and international standards.

2. Enhanced customer trust leading to higher conversions

Shoppers are more likely to complete payments when they feel safe. Strong compliance builds trust, which directly improves conversion rates.

3. Easier cross-border payments with proper frameworks

Compliance creates smoother pathways for global transactions. It reduces complications around foreign exchange and security checks.

4. Long-term business sustainability

By meeting regulations today, businesses future-proof their operations. Compliance allows them to adapt quickly as new rules are introduced.

Unique compliance-driven features

Fully compliant and highly effective, these features combine security with seamless user experiences to help your business thrive:

- 2-click checkout experience: Streamlined for faster payments without compromising security

- High success rate optimisation: Reliable infrastructure minimises failures even during peak demand

- Affordability suite: Affordability options structured to meet RBI guidelines

Building trust with the best Indian payment gateway

Digital transactions in India will keep rising and with them, the need for secure and compliant systems will only intensify. For businesses, working with the best Indian payment gateway is not just about speed but about building trust at every step.

Payment gateways like Pine Labs Online are part of this shift, providing solutions that balance compliance, reliability and smooth user experiences. As regulations evolve and payment technologies advance, the best Indian payment gateway will be the one that stays ahead, protects every transaction and empowers businesses to grow with confidence.

Santosh Kumar is a Professional SEO and Blogger, With the help of this blog he is trying to share top 10 lists, facts, entertainment news from India and all around the world.